Graduating with Financial Gains

May 19, 2021

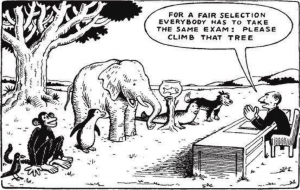

Some may say that money is power. Which in most cases, is true. As a high school student, how is this attainable? Budgeting. Finding a good saving system with your earnings is the first step. Saving money may be a foreign thing for most people and it used to be for me. But through consistency and patience I have mastered a way to save my money. Here is what I have found.

“The first step is to establish a starter emergency fund of $1000.” States Dave Ramsey

Your emergency fund is up to you. Erin Lowery suggests at least one month of expenses, if that works better for you. I started to take a portion of my bi-weekly paycheck and put it in a savings account. At first it is hard to take that pay cut, but as soon as you budget and adjust you start to not even notice or need that money. If you stay consistent you will see that amount grow and grow.

Once you have your emergency fund, I would suggest that you work towards paying off any debts. I don’t mean car loans. I am talking about store credit cards, unpaid Us or parking tickets, or paying your parents back for a small loan. This way we don’t have to worry about that. And most importantly, you don’t have to pay back interest.

Meanwhile, you need to budget. Take your income and subtract the amount you put into savings. Calculate how much you need for bills, food, drinks, and gas. Once you figure out how much you spend a month you can take that amount and put it aside once you get your paycheck. You can also go through and try to cut down what you spend money on. For example, instead of spending money on lunch everyday you can make a meal at home.

Once you start saving and budgeting you will find that you are more organized and you feel more comfortable. You will be able to buy the things you want and need without living paycheck to paycheck.