FAFSA night; plan how to pay for college before you start

October 27, 2022

On October 6th Davis High school hosted FAFSA night, inviting all seniors

and their parents to come and talk to counselors to help them apply for a Free

application for Federal Student Aid (FAFSA).

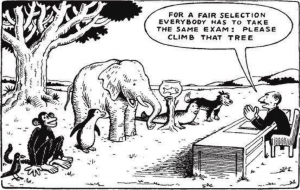

Ask your school counselor and the college financial aid office about state,

College and nonprofit grants and scholarships you can apply for. Your college uses

FAFSA data to determine you federal and eligibility.

Near the beginning of the FAFSA Be sure to meet application deadlines!

After you apply, you’ll receive your student aid report, this report explains the

types and amounts of aid a college is offering you, it also gives you your expected

costs for the year.

If you’ve been accepted to multiple colleges, compare the costs and aid

offers, accept the aid from the school that’s best for you and your goals,

remember that you can apply for FAFSA each year that you’re in college.

Generally, the school that you pick will give you your grant or loan in at

least two payments called disbursements. Your school is required to give you

these payments once per term. (Semester, trimester, or quarter).

Now its time for school, your financial aid office will apply your aid to the

amount you owe your school and send you the remaining balance to spend on

other college costs that you see fit.

One of the requirements to maintain financial aid eligibility is that you must

make satisfactory academic progress throughout, and don’t forget to complete a

FAFSA form each year.

As you prepare to graduate college get ready to repay your student loans,

federal student loan borrowers have a six-month grace period before you begin

making payments. Use this grace period to get organized and choose a repayment

plan.